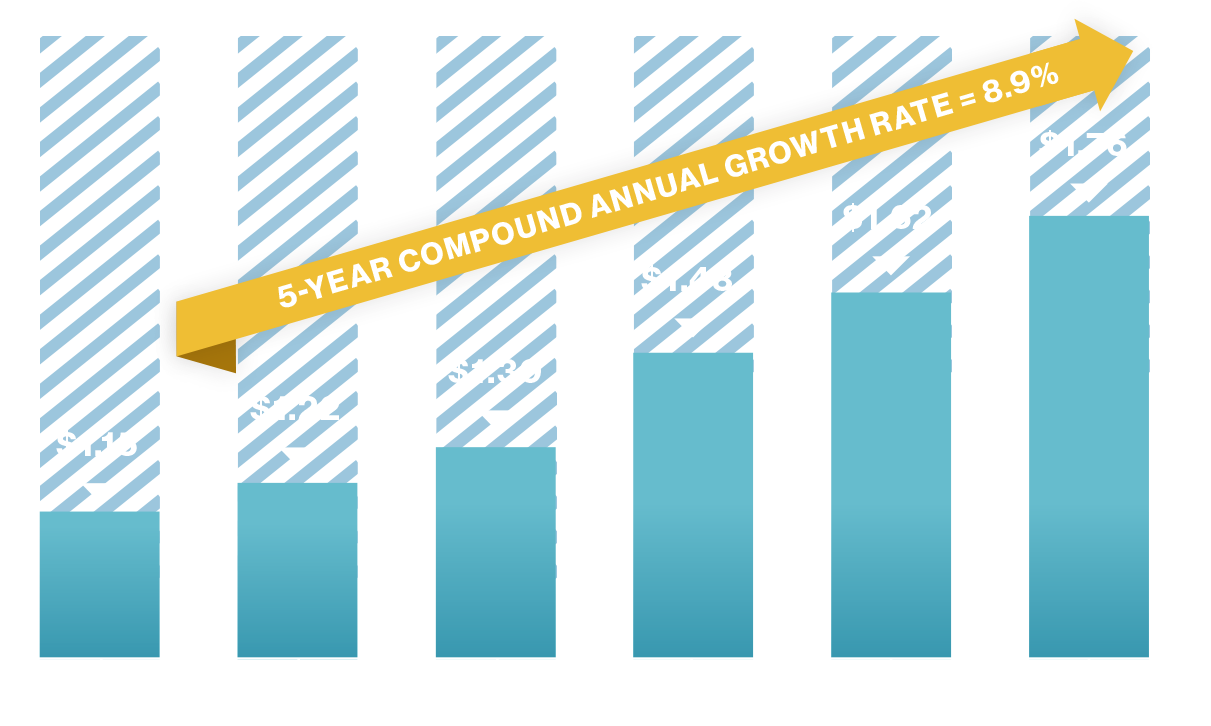

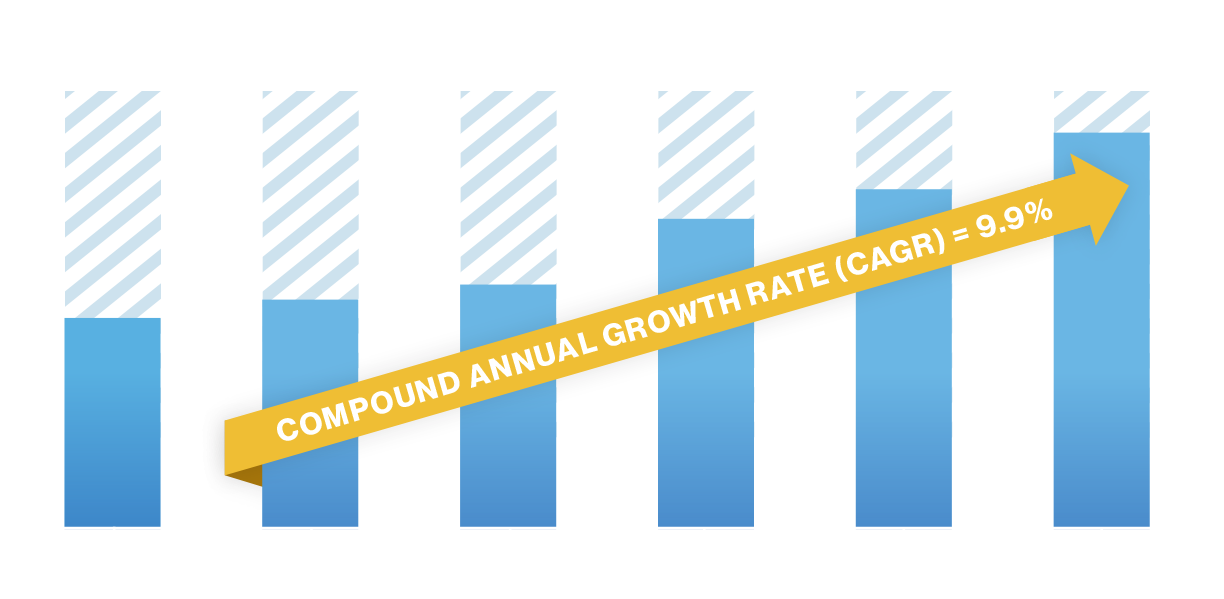

Diluted Earnings Per Share from Continuing Operations

*2017 excludes one-time Tax Cuts & Jobs Act Benefit.

2020 Diluted

Earnings Per Share

from Continuing

Operations was

a record

$4.21, an

increase

of $0.49

or 13.2%

over 2019.

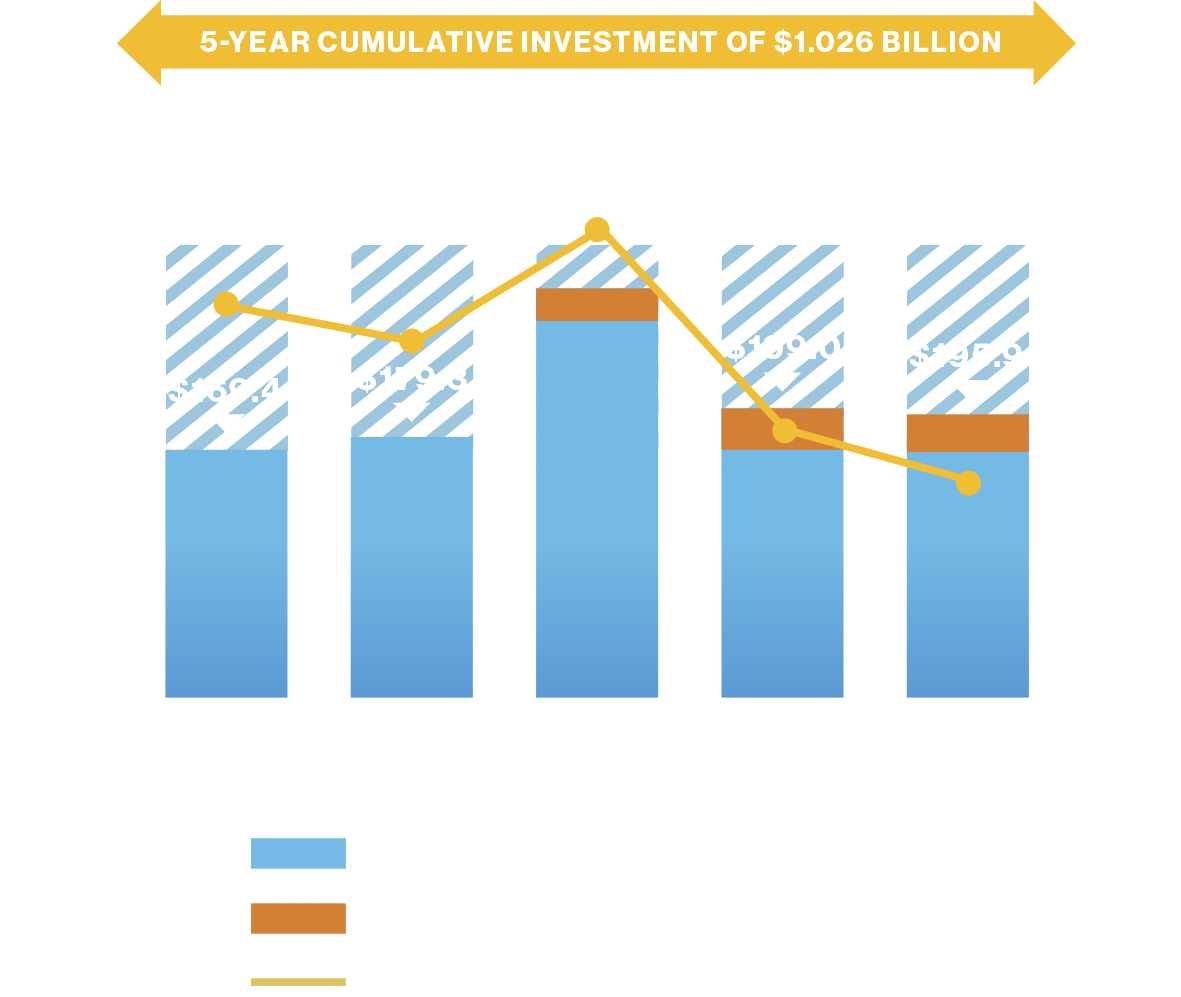

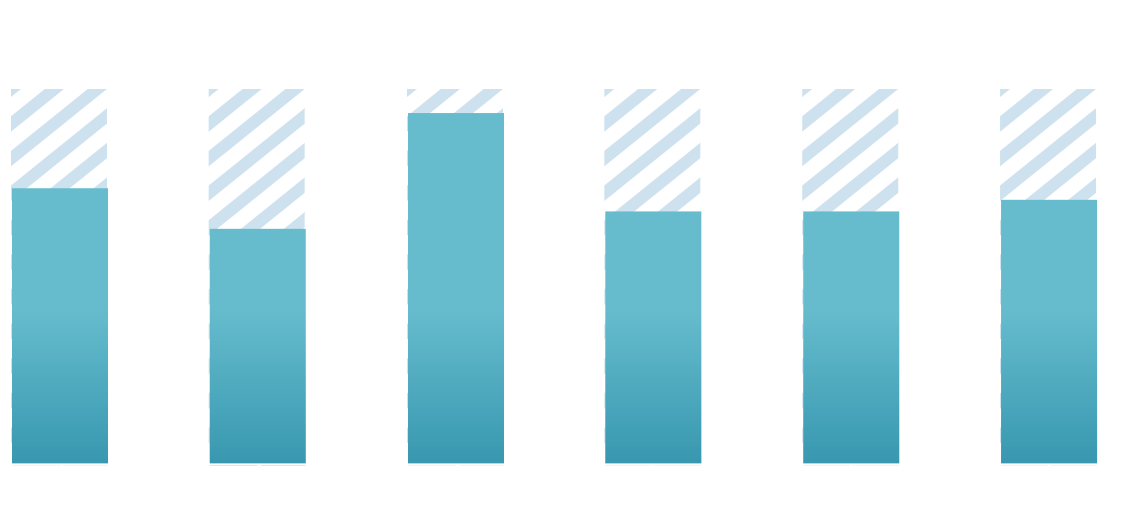

Average Return on Equity from Continuing Operations

In 2020,

we achieved an

11.5% AVERAGE

RETURN

on Equity.